Image Credit: Boulder Commons

Just two miles from downtown Boulder, Colorado, a new net-zero energy (NZE) development is under construction: Boulder Commons. The project consists of two commercial buildings totaling roughly 100,000 square feet of professional office space and boasting a restaurant, coffee shop, and community gathering flex space — all accessible by Boulder’s vast trail and public transportation network.

Rocky Mountain Institute’s Boulder-based employees will be proud to call 14,000 square feet of this development home upon project completion this fall. But perhaps more exciting than the organization’s forthcoming move is a recent major milestone involving the building owner, Morgan Creek Ventures: the signing of the first net-zero lease in the state of Colorado, and the first net-zero lease for any multi-tenant development of this size.

“Boulder Commons is setting a new bar for sustainability, and our tenants share the belief that how we act as a company matters,” said Andrew Bush from Morgan Creek Ventures. “Having RMI as an anchor tenant as well as a partner in developing a lease structure that aligned landlord and tenant goals and incentives around net zero on an annual basis pushed us further than we could have ever gone ourselves.”

Growing the net-zero movement

It was only one year ago when RMI opened the doors to its very own beyond net- zero energy Innovation Center in Basalt, Colorado. This 15,610-square-foot owner-occupied office and convening center has since garnered national and international attention as the highest performing building in the coldest climate zone in North America.

The new agreement reached at Boulder Commons enables RMI to not only continue to “walk the talk,” but to also advance the entire building industry with market-based solutions to net-zero buildings, developments, and districts.

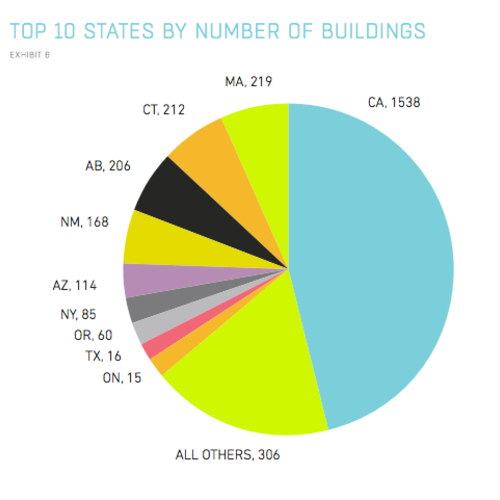

Net-zero buildings have experienced a boom in popularity over the past year. A report from New Buildings Institute revealed a 74% increase in certified and emerging net-zero buildings from 2015 to 2016. But despite industry progress, the number of leased net-zero buildings lags significantly behind owner-occupied projects. This presents a challenge to the industry’s long-term growth and viability.

Although the value proposition for an owner-occupied net-zero building is clear (lower energy and maintenance costs, higher employee productivity, and fewer employee sick days), the value proposition for both landlords and tenants in a leased building depends on a more complex relationship.

How do you true up energy use and costs on a monthly basis when they are typically calculated on an annual basis? How does a developer recoup the investment from a PV system when traditionally tenants pay a monthly bill to an electric utility and landlords have committed to buying less, not more? How can tenants prioritize energy efficiency when they manage and control only a small portion of the energy-using infrastructure and equipment? And conversely, how can landlords encourage tenants to save energy, particularly as plug loads overtake lighting to become the driving end use in net-zero energy buildings?

Managing these complexities while giving shared net-zero goals “legal teeth” is where the net-zero lease comes in.

Bridging the landlord-tenant divide

At Boulder Commons, Morgan Creek Ventures worked with RMI and its counsel, the legal team at Holland & Hart, to develop a first-of-its-kind lease structure that built a strong business case for both tenants and landlords to actively contribute to meet the development’s net-zero goals.

This process resulted in a lease that allocates a budget for factors like energy use or transportation that could make or break the development’s ability to meet energy demands through on-site renewable energy sources (in this case, a 596-kW PV system) on an annual basis. So, for example, RMI is incentivized to stay within its plug load energy budget of 7 kBtu/sq. ft. If RMI exceeds this budget, it will be charged a fee to offset this overage with renewable energy certificates (RECs), and be required to meet with the landlord to discuss ways to more proactively manage energy use. This establishes a win-win situation, because RMI has full control over how this energy budget is allocated and managed through plug loads, and Morgan Creek Ventures can more accurately size its PV system because it knows what types of loads to expect.

Transportation-related emissions are treated similarly. Unbundled parking in the lease, where the costs for parking are separated from the cost for space rent, incentivizes RMI to use alternative commuting. If RMI’s staff commute by public transportation, carpooling, or riding their bikes instead of using personal vehicles, over time RMI will pay less in rent as parking spaces are turned back over to the landlord to be put on the market. (Parking costs account for approximately 13% of RMI’s total lease cost.)

“For RMI, Boulder Commons is a great choice because it is in line with our mission. This will also attract many other companies that may not even care about sustainability or energy because it is simply a better space, and less expensive than comparable buildings in the area that don’t perform as well,” said Cara Carmichael, a manager with RMI’s buildings program. “Developing the net-zero lease was particularly exciting because we created something new. There is no template.”

Creating a net-zero lease model for others

Only a handful of other developers are actively developing net-zero multi-tenant projects, and we consulted with all of them on their process, cost structure, and lessons learned.

According to Carmichael, one of the biggest challenges with NZE buildings — and an area where there was truly no precedent in leased spaces — was the need to build ongoing annual energy reviews into the lease to enable continuous improvements in the building’s operations. This led to a lease requirement around base building commissioning, and a continued dialogue about other means to explore efficiency with each tenant in the building.

Another groundbreaking component of the lease is its treatment of offsets. At Boulder Commons, any energy purchased from the utility is required to be offset with RECs. But, committing to a single compliance path — especially when spread over a potential eight-year lease term — made project financiers uncomfortable because of long-term price uncertainty. Therefore, RMI negotiated that alternative offsets for any “dirty” power used could be implemented, including community solar, white tags (energy efficiency certificates), green power directly from the utility, or other “clean” energy attributes.

“We’ve pushed the concept of net zero in lease scenarios and established completely new ways of billing tenants for operating building use,” said Carmichael. “By having this as a model for others to use, it goes a long way. The more prototypes we can celebrate, the more confidence we’ll inspire among developers and financiers that net zero is not only a better standard environmentally but a better standard economically, as demand for high-performance buildings continues to outpace supply.”

© 2017 Rocky Mountain Institute. Published with permission. Originally posted on RMI Outlet. Kelly Vaughn is RMI’s marketing manager.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

0 Comments

Log in or create an account to post a comment.

Sign up Log in